Now Reading: Unlock Profits in Raw Material Trading

-

01

Unlock Profits in Raw Material Trading

Unlock Profits in Raw Material Trading

Commodities Trading Opportunities in Raw Materials

Are you watching your investment portfolio stagnate, feeling the pressure of inflation, and searching for ways to diversify beyond the usual stocks and bonds? Many savvy investors feel the same way, constantly on the lookout for an asset class that can offer both protection and significant growth potential. The problem is that many alternative markets seem overly complex or inaccessible, leaving you stuck in a traditional portfolio that feels vulnerable to market shocks and economic downturns.

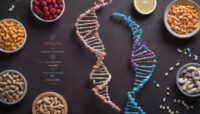

Imagine tapping into the fundamental building blocks of the global economy—the raw materials that power our industries, feed our populations, and store value through uncertain times. This is the world of commodities. Far from being an intimidating market reserved for experts, commodities trading offers a tangible and powerful way to enhance your investment strategy. This guide will demystify the world of raw materials, showing you the clear opportunities they present and how you can begin to incorporate them into your portfolio for greater resilience and growth.

What Exactly is Commodities Trading

At its core, a commodity is a basic good or raw material used in commerce that is interchangeable with other commodities of the same type. This concept, known as fungibility, is key. It means that one barrel of Brent crude oil is essentially the same as any other, and one bushel of Grade 2 corn is the same as the next. This standardization allows for a massive, liquid global market where these goods can be bought and sold efficiently. The most well-known examples include gold, crude oil, natural gas, copper, wheat, and coffee.

Commodities trading is the practice of buying and selling these raw materials to profit from their price changes. However, this rarely involves taking physical delivery of thousands of barrels of oil or tons of grain. Instead, most investors participate through financial instruments. The most common methods include trading futures contracts, which are agreements to buy or sell a commodity at a predetermined price on a future date, or through more accessible vehicles like exchange-traded funds (ETFs) that track the price of a single commodity or a basket of them. You can also invest in the stocks of companies that produce, process, or transport these materials.

Uncovering the Major Commodity Categories

The commodities market is vast and can be broken down into several key sectors, each driven by unique supply and demand dynamics. Understanding these categories is the first step toward identifying specific opportunities that align with your investment goals and risk tolerance. From the energy that fuels our cars to the metals in our electronics, each group offers a different window into the global economy.

Energy Commodities The Engine of the World

Energy commodities, primarily crude oil and natural gas, are the lifeblood of the modern world. They power transportation, generate electricity, and are essential feedstocks for the chemical industry. Because of their central role, their prices are highly sensitive to geopolitical events, decisions by major producing nations like OPEC, and shifts in global economic growth. When the global economy is expanding, demand for energy soars, often pushing prices higher.

Investing in this sector provides direct exposure to global industrial and consumer demand. The opportunity lies in correctly anticipating trends in global growth and supply disruptions. However, the risks are equally significant. Political instability, unexpected economic slowdowns, and the long-term global shift toward renewable energy can all introduce extreme volatility. Therefore, this sector is often favored by investors who have a strong grasp of global macroeconomics.

Metals The Building Blocks and Safe Havens

The metals category is typically split into two distinct groups. First are the precious metals, like gold and silver. Gold, in particular, has a unique role as a “safe haven” asset. During times of economic turmoil, high inflation, or geopolitical uncertainty, investors often flock to gold, not for its industrial use, but for its historical ability to store value when traditional currencies and stocks are falling. Silver shares some of these qualities but also has significant industrial applications in electronics and solar panels.

The second group is industrial metals, including copper, aluminum, and zinc. These are the fundamental building blocks of construction and manufacturing. Copper is so widely used in wiring, electronics, and infrastructure that its price is often seen as a barometer for global economic health, earning it the nickname “Dr. Copper.” A rising copper price can signal an expanding economy, while a falling price may suggest a slowdown. Investing here is a direct play on global industrialization and infrastructure spending.

Agricultural Commodities Feeding the Globe

Agricultural commodities, also known as “softs,” include everything from grains like wheat, corn, and soybeans to other products like coffee, sugar, and cotton. These markets are driven by some of the most fundamental forces imaginable: population growth, changing dietary habits, and, most critically, the weather. A growing global population requires more food, creating a long-term upward pressure on demand.

The unique factor in this category is the immense impact of unpredictable natural events. A severe drought in Brazil can send coffee prices soaring, while a bumper crop in the American Midwest can cause corn prices to plummet. This makes agricultural commodities highly volatile but also presents opportunities for investors who can analyze weather patterns, crop reports, and global consumption trends. It’s a direct investment in the essential business of feeding the planet.

Why You Should Consider Investing in Commodities

One of the most compelling reasons to add commodities to your portfolio is for diversification. The prices of raw materials often move independently of the stock and bond markets. For example, a geopolitical crisis that causes fear in the stock market could simultaneously cause oil and gold prices to spike. This low or negative correlation means that when one part of your portfolio is down, your commodity holdings may be up, helping to smooth out overall returns and reduce volatility.

Furthermore, commodities are widely regarded as one of the most effective hedges against inflation. Inflation is, by definition, a rise in the price of goods and services. Since raw materials are the primary inputs for those goods, their prices are a leading component of inflation. By owning commodities or commodity-linked assets, your investment can rise in value along with the cost of living, helping to protect your purchasing power in a way that cash or fixed-income bonds cannot.

Getting Started and Managing Risks

For most investors, the easiest entry point into commodities is through Exchange-Traded Funds (ETFs) or Exchange-Traded Notes (ETNs). These securities trade on a stock exchange just like a regular stock. You can buy an ETF that tracks the price of a single commodity like gold (GLD) or a broad basket of diverse commodities (DBC), offering instant diversification within the asset class. Another straightforward method is to purchase shares of companies involved in the commodity business, such as major oil producers, mining corporations, or agricultural firms.

It is crucial to approach commodities with a clear understanding of the risks. This market is notoriously volatile, with prices capable of making sharp and unpredictable moves. Supply shocks, weather events, and sudden policy changes can cause dramatic swings. For this reason, it’s wise to allocate only a small portion of your overall portfolio to commodities. Start with a modest investment, conduct thorough research on the specific commodity or fund you are interested in, and never invest more than you are prepared to lose. When used thoughtfully, commodities can be a powerful tool for building a more robust and well-rounded investment portfolio.